A payroll correctly done is a joy for everybody. An obvious statement, but there is more than the eye can see at first chance. That is this article about. Doing the salary administration correct brings more than you expect.

A payroll correctly done is a joy for everybody

In the situation that a Dutch resident tax payer is offered to work remotely for a foreign company implies challenges. The first challenge is with the employee, as employment in the Netherlands is fully taken care of. Will this be the same?

The challenge for the foreign company is the setup of the engagement. We see many companies dive for Dutch obligations. That is then avoided by setting up a contracting agreement. The foreign company converts the employee in an entrepreneur not at free will. The consequences cannot be overseen by the employee. The company is happy not to have obligations in the Netherlands.

So far there is no joy, right?

The main rule of employment and taxation

The main rule is that tax is to be paid in the country where the employment is actually done. Of course there are some exceptions. Everybody knows the 183 day rule, nearly nobody understands what the 183 day rule implies. In this situation the 183 day rule is not applicable, hence the main rule applies.

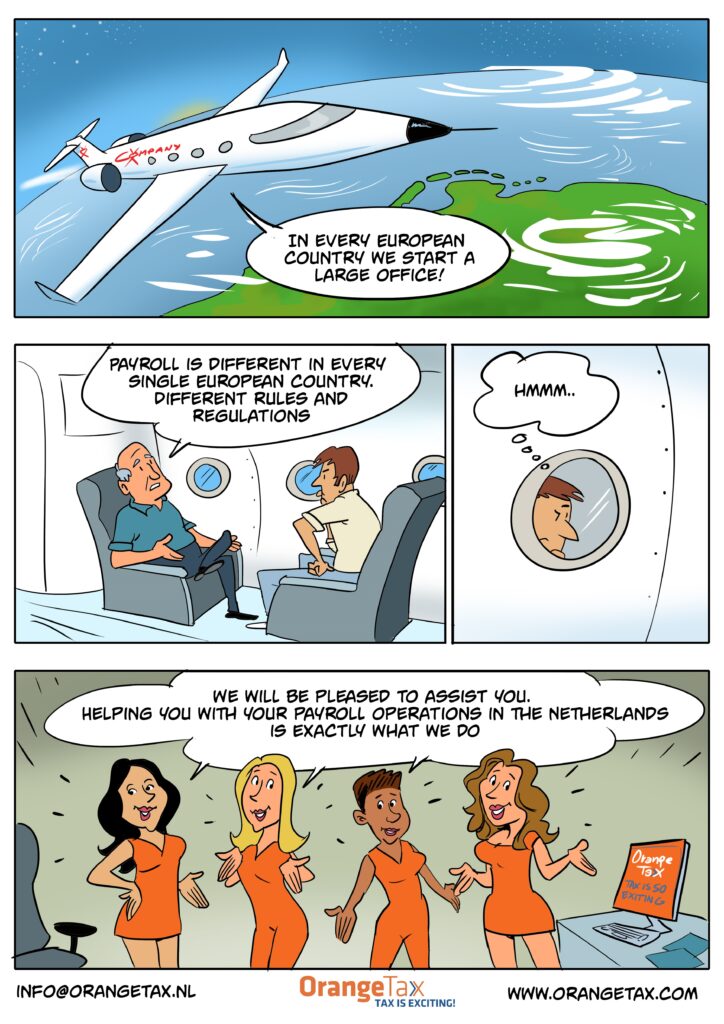

The main rule implies the foreign company needs to set up a payroll in the Netherlands. That is a service we can provide with. The moment the payroll has been set up, the employee is then also subject to Dutch social premiums. That implies the employee is insured for disability and unemployment as well.

The main rule implies the employee is being paid and taxed as if the employee was employed with a Dutch resident employer.

Contracting

Some foreign employers suggest contracting and state they do not want to set up a Dutch payroll. In international situations the one client is no client rule is not applicable. Hence it is possible.

Parties need to understand that the employee is converted into a contractor. Hence no longer an employee but an entrepreneur. The entrepreneur needs to comply with the rules with respect to correctly invoicing, bookkeeping, filing tax returns for the company themselves. No disability insurance, no unemployment benefit. No more mortgage deduction, still a deduction for the house, but it is different now.

The Dutch employee converted into a contractor will not be comfortable. You have employed an uncomfortable employee. Not a joy.

Tax is exciting

We think tax is exciting and that payroll correctly done is a joy.

What is a joy with respect to payroll? That is for the employer that the work is done, instructions are received what payment needs to be done and that the tax formalities are taken care of.

What is a joy for the employee? That there is work to do, employer instructions are send and the salary is being paid on the expected date. Simple as that.

And exactly that is a service we provide. This service makes it a joy for both the employer and the employee. The rules with respect to taxation on employment are applied.

I kindly invite you to connect to our payroll team to be updated about the joyful service we provide and the fixed fees that are connected to this service.