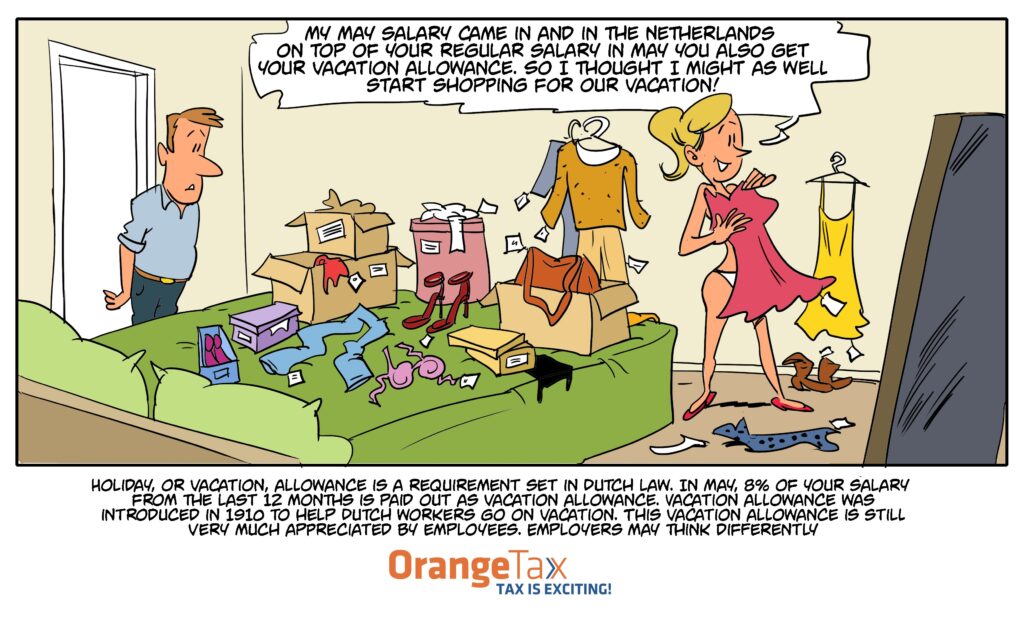

Vacation allowance or holiday pay is a hot topic in the month of May in the Netherlands. Hot with the employees, as they are super enthusiastic. Hot with employers as they do not understand the sudden increase in employment costs.

Vacation allowance

Vacation allowance introduced in 1910 by our Government. Employees around that time earned enough income to pay for the rent, groceries and small joys of life like the cigarette. There was no budget for an actual holiday.

The holiday pay enables the blue color workers to enjoy a holiday.

How does vacation allowance work?

The holiday pay is 8% salary calculated over salary earned during the previous 12 months. Only regular earned salary applies. Bonusses are not part of the calculation. Whether you are a Dutch resident tax payer. Whether you are a non resident tax payer. The holiday pay applies to you being employed by a Dutch employer.

Working remotely for a foreign employer from your home in the Netherlands, makes you entitled to the vacation pay. The rule with remote working is that the place where you actual perform the job is the country that can tax the salary income. If you work from home for a foreign company, Dutch wage tax applies. The moment Dutch wage tax applies, Dutch labour law applies as well. Part of the Dutch labour law is the holiday allowance.

How does the holiday pay work accounting wise?

The payroll ran for the employer takes every month already into account 8% of the salary of that month for the vacation pay out moment. It is a reservation that falls free in the month of May or June. That implies the moment holiday pay is being paid, the employer does not have in that specific month double payroll costs.

What makes holiday pay vacation allowance?

The employer can argue that in December a 13th month is paid, that equals the vacation allowance. This is not correct. Such argument is not valid. Holiday pay is identified by law as an 8% remuneration paid in May or June.

If it is decided to pay the holiday pay in another month than May or June, such an allowance can then not be regarded to be vacation allowance. This implies the employees are no paid holiday pay and can still claim to be paid the holiday pay.

Some internationals are unfamiliar with the concept of holiday pay and prefer to have 1/12 of the holiday pay paid out monthly. This aspect can be agree in the employment agreement.

Tax is exciting!

We think tax is exciting. Vacation allowance is exciting! Research learned that most employees do not actually use holiday pay for vacation, but to either pay outstanding debts or larger purchases like a TV, scooter or things like that.