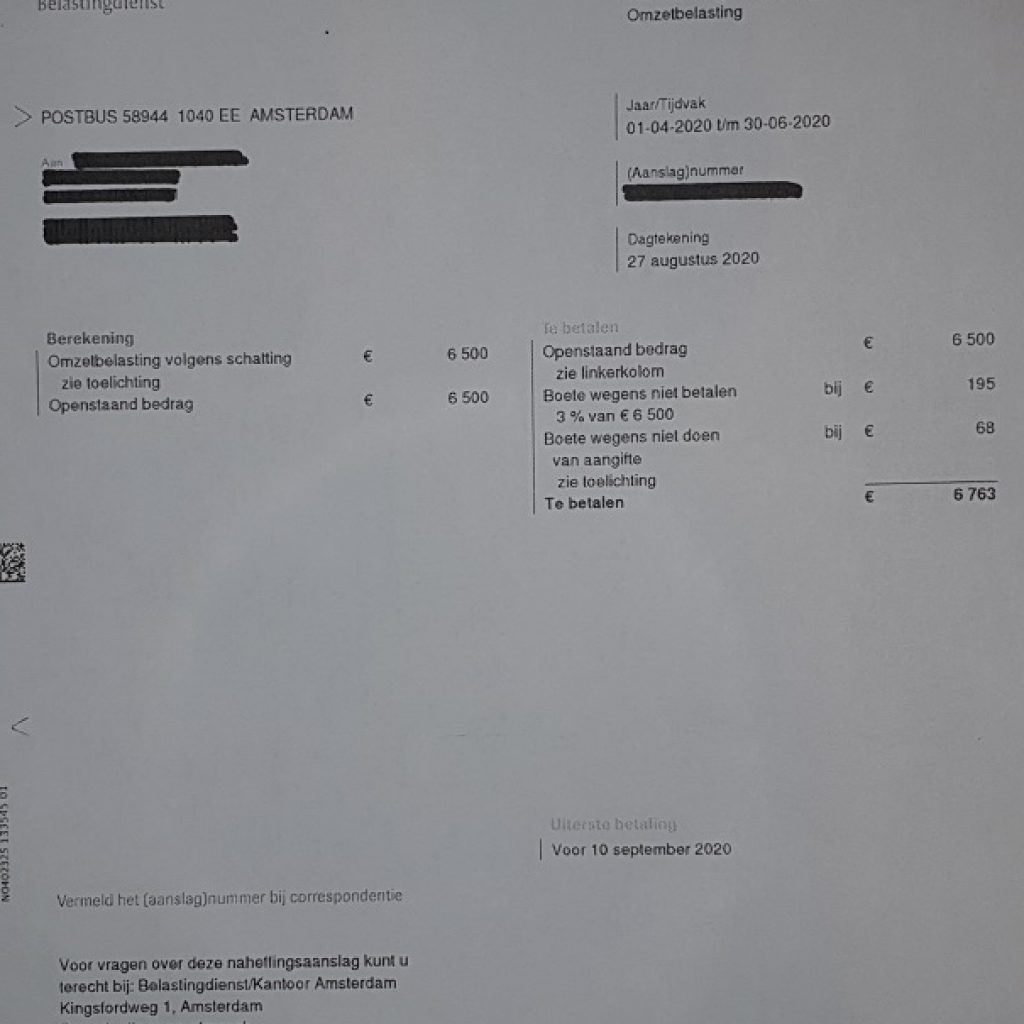

Naheffingsaanslag omzetbelasting, that is what we call ugly. Ugly in the sense that you are charged with a huge amount and you have no idea how the tax office came up with that amount. How to solve something ugly?

Naheffingsaanslag omzetbelasting, what is that?

The word Naheffingsaanslag is a word only used when it involves tax. As you know we love tax, but not the naheffingsaanslag. This is basically an assessment for tax you were supposed have paid already, but you did not.

The word omzetbelasting is Value Added Tax, for the purpose of this article referred to as VAT. VAT you know, or you should know.

What is the naheffingsaanslag omzetbelasting about?

Actually it is very simple and effective. When you registered a company, and you did, as such assessments are only send to entrepreneurs, you were also issued a VAT number. With the VAT number you were told when to file the VAT return. Often that is a quarterly obligation, but it can also be annual.

The tax office expects you to file as you were told by them. The reality is that most starting entrepreneurs misinterpret this obligation. The assumption is that this VAT return is obliged to be filed when VAT was charged to a client. Often in the start up face nothing was charged yet, hence no VAT to be reported. This makes starting entrepreneurs assume there is no need to file a VAT return.

That is an incorrect assumption. The VAT return is always filed, even if nothing is to be reported. But is there nothing to be reported when you have not issued any invoice yet to a client? Of course there is! You made costs and we can only assume you received a receipt in name of the company. And on that receipt is stated you paid VAT on the costs made. That paid VAT you can reclaim from the tax office.

So suddenly the strange obligation can become an opportunity to claim some tax back. Are you getting excited already? We are.

How to get you in line?

You have not filed the VAT return. You either forgot, did not know how to file or were under the assumption that with no turnover, no VAT return needs to be filed.

The tax office is keen to get you in line and in the Netherlands that is done with ex officio assessments. An ex officio assessment is an assessment where the tax office puts in a random amount. The random amount is random enough to get you to respond. If you do not respond, the tax office will ask the collector to collect the amount. It is not a suggestion, it is an assessment.

What are the intentions of the tax office?

What are the intenetions of the tax office with this naheffingsaanslag omzetbelsting? The intention is not to collect the random amount they charged you. The intention is to force you to investigate how to solve this naheffingsaanslag omzetbelasting. Often you investigate and come to the conclusion you need an accountant.

Do you need an accountant? Call us – Tax is Exciting!!

We can help you out solving this naheffingsaanslag omzetbelasting. Excitement could come from holding your hand, to help you through the process. We also assist you in setting up your administration in such a manner that you do not get such an assessment the next quarter again. Feel free to contact us.