Today one of my clients forwarded me an email message. Apparently she had with the Dutch tax office an outstanding amount to be paid, if she would be so kind to pay this amount to the bank account mentioned in the message.

Email spam

This is of course spam, the Dutch tax office is very much aware of the dangers email traffic contains, hence they do not or in a limited number send email messages. Certainly no payment requests are made via email. No tax office spam.

How can you recognize that the message from the tax office is indeed a fraudulent message?

- The so called outstanding debt was EUR 83,04. You never receive an assessment from the tax office with after comma digits.

- The bank account number mentioned was an ABN AMRO number. The Dutch tax office uses the following bank account number: NL86 INGB 0002 4455 88. Should they use another bank account number, that is possible, verify this via the website of the tax office, or call them.

- More important, do not pay if you do not know what it concerns.

Not spam, genuine messages

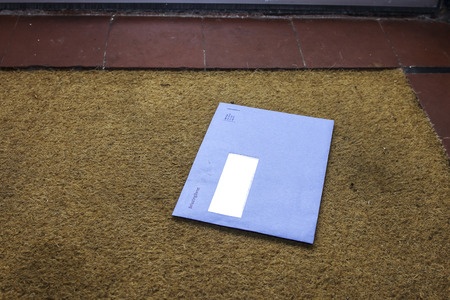

Blue envelops in Dutch mail are all send by the Dutch tax office. The blue envelop is used for your road tax, income tax, value added tax, wage tax, corporate tax and questions the Dutch tax office would like to ask you. Everybody in the Netherlands is very much aware of the contains of blue envelops: tax.

Not opening and or not responding if required to the demand of the blue envelop will result in substantial more blue envelopes. This is not the position you would like to get into.

Complaint against assessment

If you disagree with the contains of the blue envelop, for instance you expected a tax refund, but the assessment shows an amount to be paid. This often happens with migration income tax returns. Either contact your tax advisor (us) or make inquiries yourself with the Dutch tax office. The latter will not always result in the answer to your question. If you are indeed correct in your stand point that you should have received a refund, you need to file an complaint within six weeks from the date of the assessment.

Payment arrangement with tax office

The situation where you are requested to pay and you know you are due the amount, but you simply have no money to pay for the assessment, then you also need to take action. You need to contact the Dutch tax office immediately and ask them what to do if you cannot pay.

The tax office will then request you to complete a form in which you report all your possessions. Based on that form the tax office will decide what you need to sell in order to pay for the tax. In the worst case scenario that could be your home, if the value exceeds the loan on the house.

In the situation that you cannot pay the full amount at once, but over time, make this suggestion to the tax office. Do not expect the tax office to always accept your suggestion, they will demand a shorter period of payment.

When you cannot pay the road tax of your car, the car is always sold immediately. Taking away the source of the tax, makes the future claim stop. If you happen to have a car that does not yield the amount of road tax on sale, does not imply your debt is erased, you still need to pay for the difference.

Orange Tax Service

We cannot assist you with payment issues with the Dutch tax office. The simple reason is that if the tax office understands we assist you, the tax office will reason “ If they can pay for the tax advisor to assist, they can pay us”. No deal will be the result.

We can assist in case the assessment is not correct. In our experience we find that most social premium calculations in migrant income tax returns are not correct. And the social premiums were the cause for the refund. Sometimes the education deduction of previous years set forward is not accepted, or other differences. We can either explain to you the assessment is correct, or explain to you that a complaint needs to be made. For Orange Tax Services clients for whom we have filed the income tax return, this complaint is included in the fee, for other clients we charge additional for this service.