How Does Payroll Work for Foreign Employers in the Netherlands?

Payroll Work for Foreign Employers in the Netherlands is a hot topic, as many employees move to the Netherlands for

1016 CS Amsterdam

Lines close at 4pm

Our office hours

Here are the blog posts tagged with the term you were searching for.

Payroll Work for Foreign Employers in the Netherlands is a hot topic, as many employees move to the Netherlands for

The one client is no client solution. The creative persons referring to themselves as tax advisors have plenty of solutions.

One client is no client in 2025 is the standpoint of the Dutch tax office. Rules will be enforced from

Doing business in the Netherlands can involve employment. Employment and Dutch taxation are sometimes a topic of hesitance due to

Stock options exercised and tax, FAQ. One the question is asked by the employee what options they have. Indeed, what

US Inc doing business in the Netherlands. That involves a registration in the Netherlands, but which one do you chose?

Employer abroad – working remote – Dutch taxation that is a frequently asked question, the answer is simple, the execution

Filing your American taxes while being a Dutch tax resident. Under certain circumstances you can deduct the days worked abroad.

We have an employee in the Netherlands! This could cause distress with foreign employers. The only stories told to them,

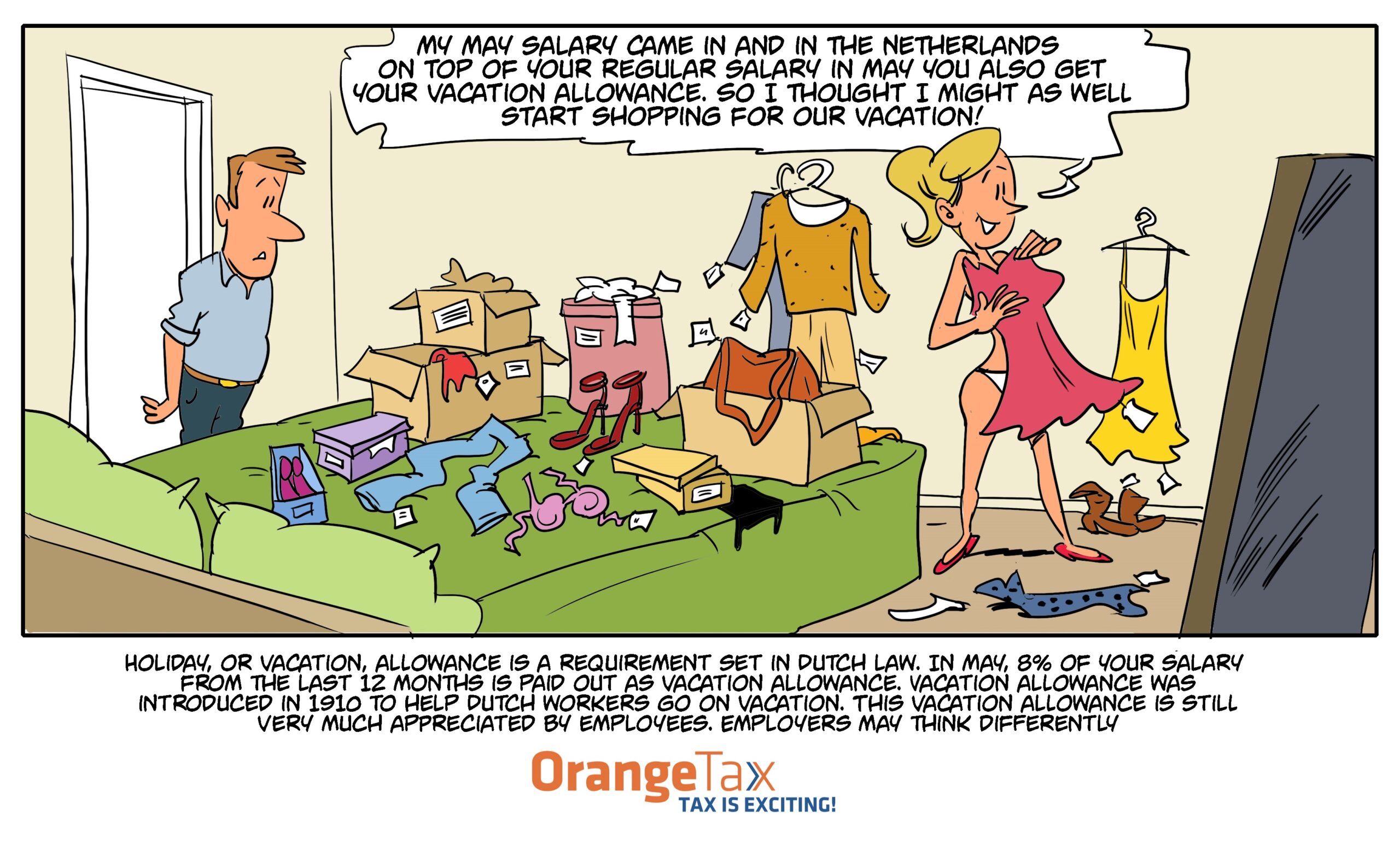

A payroll correctly done is a joy for everybody. An obvious statement, but there is more than the eye can

For deeper coverage of various Dutch tax topics, download one of our White Papers from the menu.