10 common mistakes when setting up a BV in the Netherlands

The BV company is the Dutch limited liability company. 10 common mistakes when setting up a BV is what this

1016 CS Amsterdam

Lines close at 4pm

Our office hours

Here are the blog posts tagged with the term you were searching for.

The BV company is the Dutch limited liability company. 10 common mistakes when setting up a BV is what this

The 2024 income tax return can be filed starting from February 1 next. We will be pleased to assist you.

Doing business in the Netherlands can involve employment. Employment and Dutch taxation are sometimes a topic of hesitance due to

Stock options exercised and tax, FAQ. One the question is asked by the employee what options they have. Indeed, what

Employer abroad – working remote – Dutch taxation that is a frequently asked question, the answer is simple, the execution

Filing your American taxes while being a Dutch tax resident. Under certain circumstances you can deduct the days worked abroad.

The alternative tax Halloween. You think you had a good night last night (October 31), we Dutch tax advisors had

30% ruling and signing employment contract, often an issue when nearly too late. Now it was too early, or was

The 30% ruling and minimum salary, not always understood, sometimes ever overlooked or missed. What is the case? The 30%

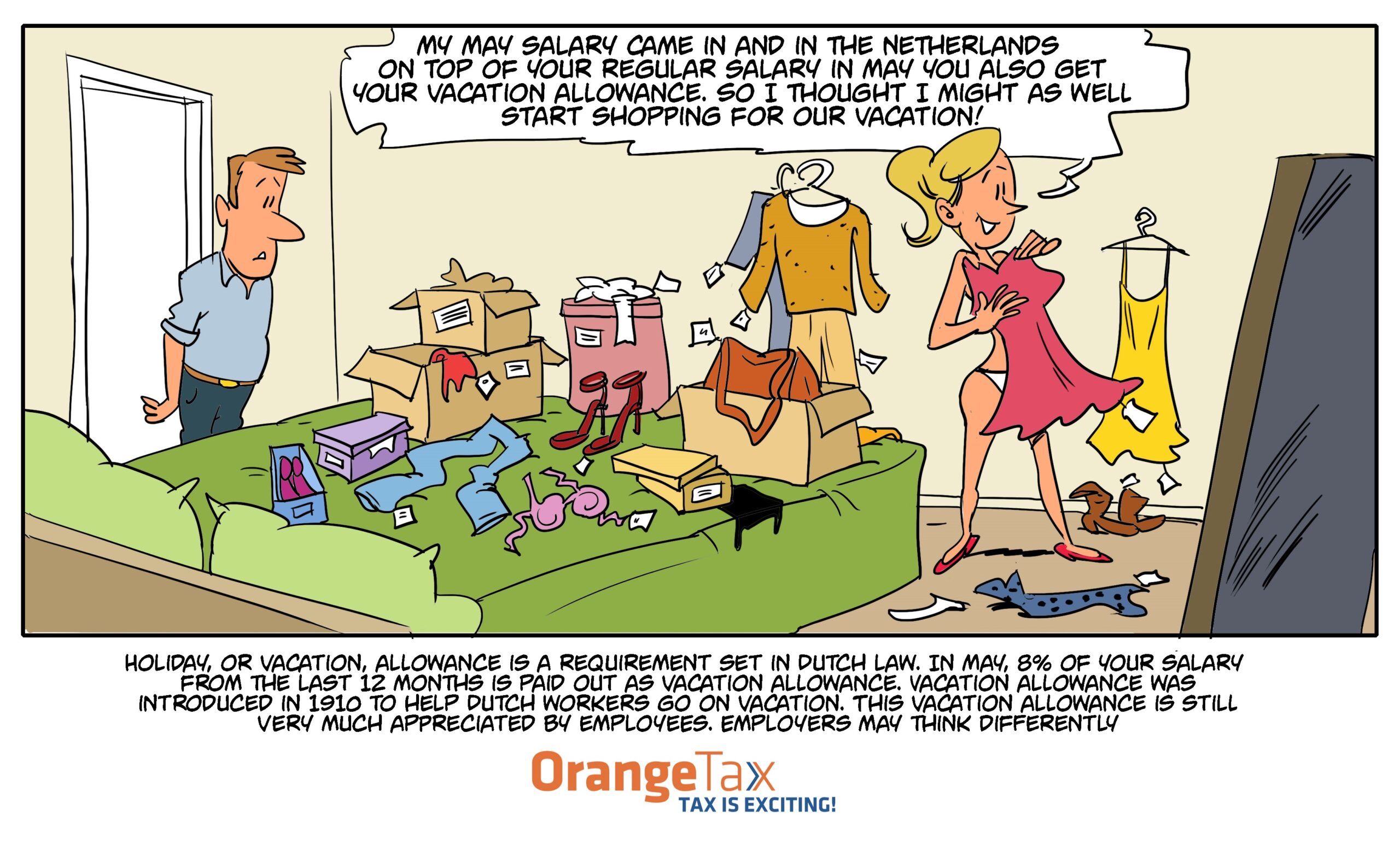

Holidays are coming and you travel to your US family. To spend more time there you travel earlier and continue

For deeper coverage of various Dutch tax topics, download one of our White Papers from the menu.