Filing your American taxes while being a Dutch nonresident tax payer. What is that about? Voluntary paying Dutch tax? That is indeed not the case.

Filing your American taxes while being a Dutch nonresident tax payer

You are a Dutch tax resident when your central point of life is in the Netherlands. The moment you move your central point of life abroad, you migrate. Then you file for that year the Dutch migration income tax return. The following year you could be a non-resident tax payer.

When are you regarded a non-resident tax payer?

There are a number of situations. The most common one is that you own property in the Netherlands, while you are not a Dutch tax resident. That implies you either did not sell your home when you left the Netherlands or you simply made an investment in the Netherlands, in property.

The other situation is when you moved abroad, but you come back to the Dutch office to work. The moment you work in the Netherlands, Dutch tax applies. Hence you are as a non-resident subject to Dutch tax on your labour income.

What tax can you expect as a nonresident tax payer?

This is not exactly a nice topic to address, as the tax rates changed dramatically for the worse. If you own property in the Netherlands, you are taxed in Box 3 for that property. Box 3 taxes assets. The tax rate is based on an assumed yield on your investment of 6,17% (2024) taxed at 36% tax (2024). The base of that calculation is the WOZ value of the property. The WOZ value is the value set by the city the property is located in.

You might have a debt on the house for the purchase. That is taken into account as well, but less. So you are assumed to make 2,28% costs on the debt and at the 36% tax rate this reduces the Box 3 taxation.

There is a tax free amount of EUR 57.000 per person. Only the excess of that amount results in taxation.

If you also hold a bank account in the Netherlands to collect rental income or to be able to pay for the loan. That asset is not part of the Dutch non resident tax return.

Are you double taxed as a US national/green card holder and Dutch non resident tax payer?

Now I enter the territories of BNC Tax where they have the expert knowledge of US taxes. The answer is from a Dutch perspective: a little bit.

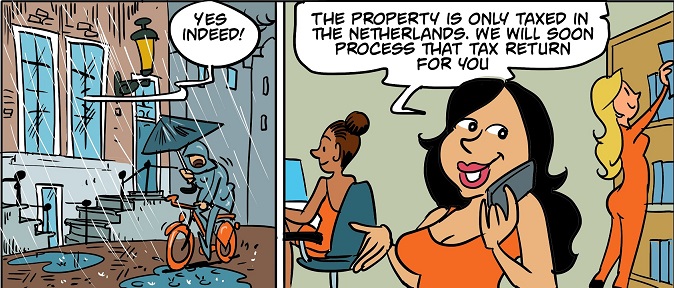

The Dutch American tax treaty states that properties are taxed in the country where the property is located. Of course it would not be a tax treaty if the word ‘May’ was not used. As you reported your income and assets again in your US tax return, we expect you pay a little bit over the Dutch property. But please check with BNC tax.

Is there a point in filing the Dutch tax return as non resident if we also pay US tax?

You could be teased when you live far away from the Netherlands to disregard your non resident tax obligation for the property you own in the Netherlands. That is part of being a human being. The tax office is accustomed to work with human being, hence they have means to enforce you.

The obvious enforcement is inviting you to file, reminding you to file, summoning you to file. Every step is joint with a penalty. These penalties the Dutch tax office needs for the final act. And the final act is to use their power to sell your property at auction to settle the tax debts. Mind you, only the tax debts.

We can only assume that if you own a property in the Netherlands, part of the game is paying tax in the Netherlands. We will be pleased to assist.

As we are aware of this fact and that you have a mid April deadline, we offer an early service. Early in the sense that the software that enables us to process your Dutch return is ready early February. Hence early February we can process your Dutch tax return. The moment you have provided us all we need, maximum of three working days it takes to turn around the income tax return.

Feel free to connect with us. Our 2024 rate is EUR 430 incl VAT including tax partner for a regular income tax return. An entrepreneurs income tax return is charged at EUR 590 excluding VAT including tax partner. Please connect with us via info@orangetax.nl

IamExpat webinar filing your American taxes

February 27 at 19.00 hours BNC tax and Tax is Exciting organize via the IamExpat platform a webinar about the US Dutch tax combination. Feel free to join us. We do appreciate that very much !