Employer abroad – working remote – Dutch taxation that is a frequently asked question, the answer is simple, the execution not always.

Employer abroad – working remote – Dutch taxation

We experience often that a couple moves to the Netherlands for a variety of reasons, the partner follows. The partner often anticipates that finding work in the Netherlands could be complex. Plus the work being done now is a good job, a familiar job. A job the partner prefers to keep. The job can be done remote, so why not continue working for the previous employer, but than from the Netherlands.

Dutch taxation

The Netherlands has tax treaties with a high number of countries. The tax treaties are based on a general principle used in the world. The result is that work done in the Netherlands, is taxed in the Netherlands. That implies that the remote work done in the Netherlands for the foreign employer is subject to Dutch wage tax. On top of that, Dutch labour law is also applicable.

Dutch payroll

You google, find our splendid non resident employer payroll service and you forward our quote to your foreign employer. The foreign employer is hesitant. Despite we state no exposure in the Netherlands other than the salary that is taxed for the Dutch employer, the hesitance stays. The Dutch labour law is unknown, the obligations are a risk for the company. The employer declines our offer. What now?

Employee becomes entrepreneur

The employee is informed that the remote employer does not set up a Dutch payroll. Then the switch is made to the employee becoming an entrepreneur. A transparent ZZP, freelance or one man company is registered with the Chamber of Commerce. Invoices are send, tax is calculated and it turns out this method is much cheaper. But is it?

We advocate for employment over entrepreneurship

The employee becoming an entrepreneur is cheaper when you compare an apple with a pear. But if you compare apples with apples, the picture is much different. The employer pays also social premiums, the unemployment benefit, disability benefit and employers part of the health care insurance.

As entrepreneur you cannot insure yourself for unemployment, that is the risk of self employement. You can insure yourself for disability, but have you ever tried that? For a mickey mouse income due to being unable to work, you pay a substantial premium. Some even state: an insane premium. The day you would like to make use of that insurance, the request is often dismissed.

Moreover, you are not protected whatsoever. In other words, the remote employer that has become your remote client can dismiss you without consequence any day or time of their liking. Whereas an employee is protected by labor law.

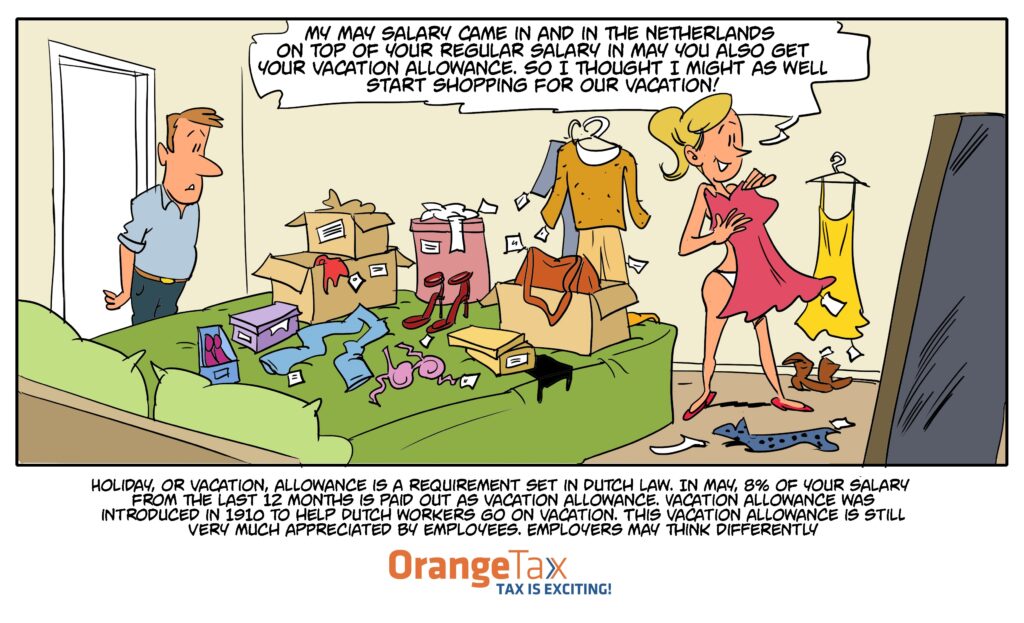

Tax is exciting

Yes we think tax is exciting, and paying less tax is even more exciting. The exception to that rule is employment versus self employed. The self employed income taxation is lower than salary income. However, if the social aspect benefits are taken into account, the employment is outperforming self employment. Hence we advocate employment and if your foreign employer is not willing to comply with employment, there are plenty other employers happy to employ you. We will be pleased to facilitate that with our payroll service.