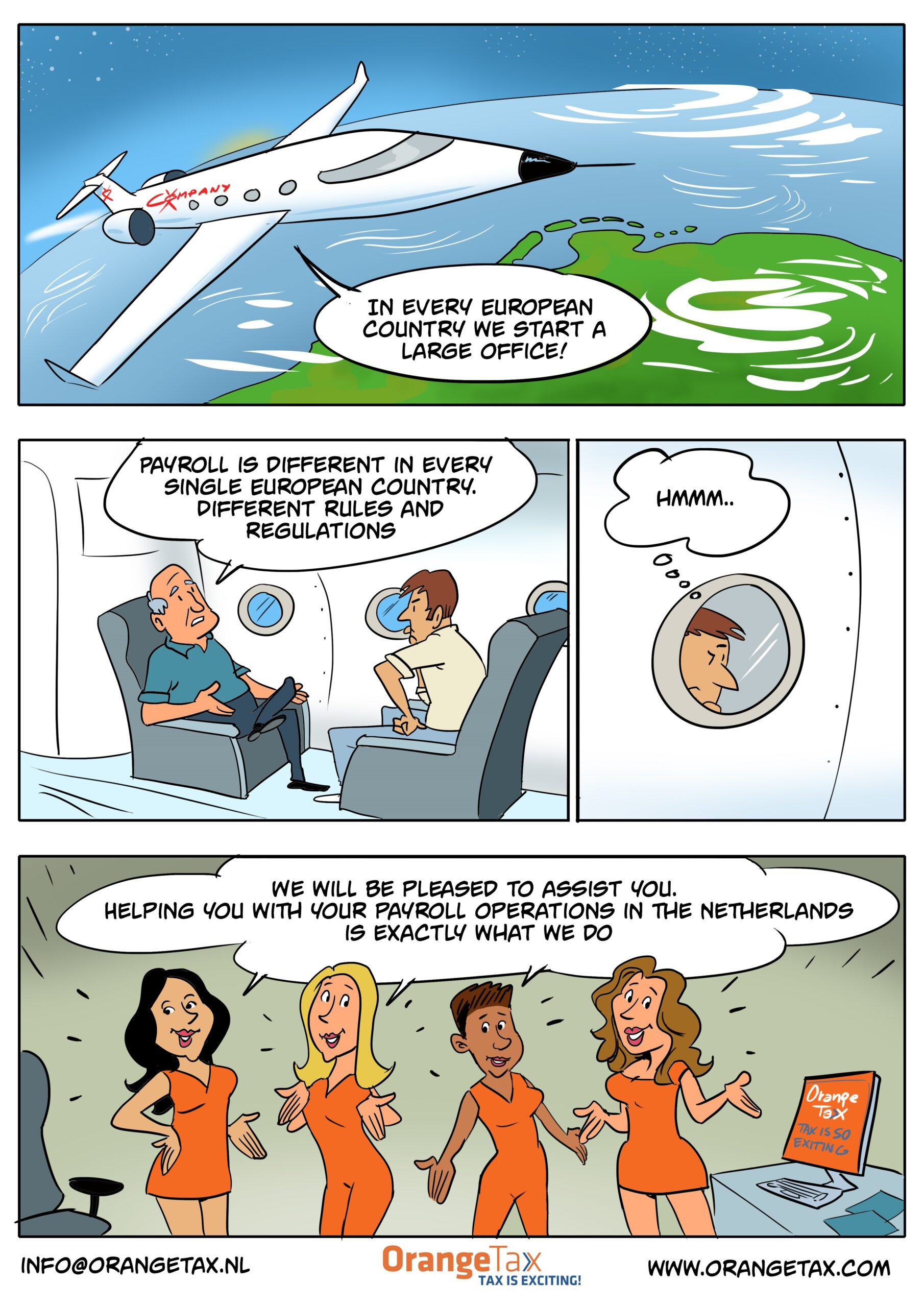

How Does Payroll Work for Foreign Employers in the Netherlands?

Payroll Work for Foreign Employers in the Netherlands is a hot topic, as many employees move to the Netherlands for

1016 CS Amsterdam

Lines close at 4pm

Our office hours

Payroll Work for Foreign Employers in the Netherlands is a hot topic, as many employees move to the Netherlands for

The BV company is the Dutch limited liability company. 10 common mistakes when setting up a BV is what this

The one client is no client solution. The creative persons referring to themselves as tax advisors have plenty of solutions.

BV company yearend bookkeeping is coming as the year is ending! What do you need to do, tax wise? BV

One client is no client in 2025 is the standpoint of the Dutch tax office. Rules will be enforced from

Holiday and costs go hand in hand. But would some of these costs be tax deductible? Maybe yes. Holiday and

Doing business in the Netherlands and the company car. Since decades a hot topic, also today. Doing business in the

Doing business in the Netherlands can involve employment. Employment and Dutch taxation are sometimes a topic of hesitance due to

Stock options exercised and tax, FAQ. One the question is asked by the employee what options they have. Indeed, what

US Inc doing business in the Netherlands. That involves a registration in the Netherlands, but which one do you chose?

Payroll Work for Foreign Employers in the Netherlands is a hot topic, as many employees move to the Netherlands for many reasons. The weather is

The BV company is the Dutch limited liability company. 10 common mistakes when setting up a BV is what this article is about. Mistake 1:

The one client is no client solution. The creative persons referring to themselves as tax advisors have plenty of solutions. But are these solutions or

BV company yearend bookkeeping is coming as the year is ending! What do you need to do, tax wise? BV company yearend bookkeeping Around this

One client is no client in 2025 is the standpoint of the Dutch tax office. Rules will be enforced from coming January. What does this

Holiday and costs go hand in hand. But would some of these costs be tax deductible? Maybe yes. Holiday and costs – the company car

Doing business in the Netherlands and the company car. Since decades a hot topic, also today. Doing business in the Netherlands – company car –

Doing business in the Netherlands can involve employment. Employment and Dutch taxation are sometimes a topic of hesitance due to the Dutch tax rates. Doing

Stock options exercised and tax, FAQ. One the question is asked by the employee what options they have. Indeed, what options does the employee have?

US Inc doing business in the Netherlands. That involves a registration in the Netherlands, but which one do you chose? US Inc doing business in

For deeper coverage of various Dutch tax topics, download one of our White Papers from the menu.