Holding structure or no holding structure?

Holding structure or no holding structure, that is the question. Not frequently asked, more an announcement. A proud announcement, but

1016 CS Amsterdam

Lines close at 4pm

Our office hours

Holding structure or no holding structure, that is the question. Not frequently asked, more an announcement. A proud announcement, but

The entrepreneur becomes rich overnight fairytale. A fairytale you must have seen on a social platform. True or false? The

Doing business in the Netherlands can involve employment. Employment and Dutch taxation are sometimes a topic of hesitance due to

Dutch corporate income tax penalties are serious amounts. Nothing exciting about the penalties, but we are excited to see how

US Inc doing business in the Netherlands. That involves a registration in the Netherlands, but which one do you chose?

Maintaining your US Inc in the Netherlands. That is often a desire for many reasons. We will be pleased to

Being a sole director of a foreign company residing in the Netherlands, makes the foreign company subject to Dutch rules

No tax audit due to missing administration? Submitting your administration with the garbage, does that make you cannot be audited?

Employer abroad – working remote – Dutch taxation that is a frequently asked question, the answer is simple, the execution

The 2024 tax assessment. Maybe you already received it, and the year hardly began! Can I not simply ignore it?

Holding structure or no holding structure, that is the question. Not frequently asked, more an announcement. A proud announcement, but I wonder why sometimes. Holding

The entrepreneur becomes rich overnight fairytale. A fairytale you must have seen on a social platform. True or false? The entrepreneur becomes rich overnight Probably

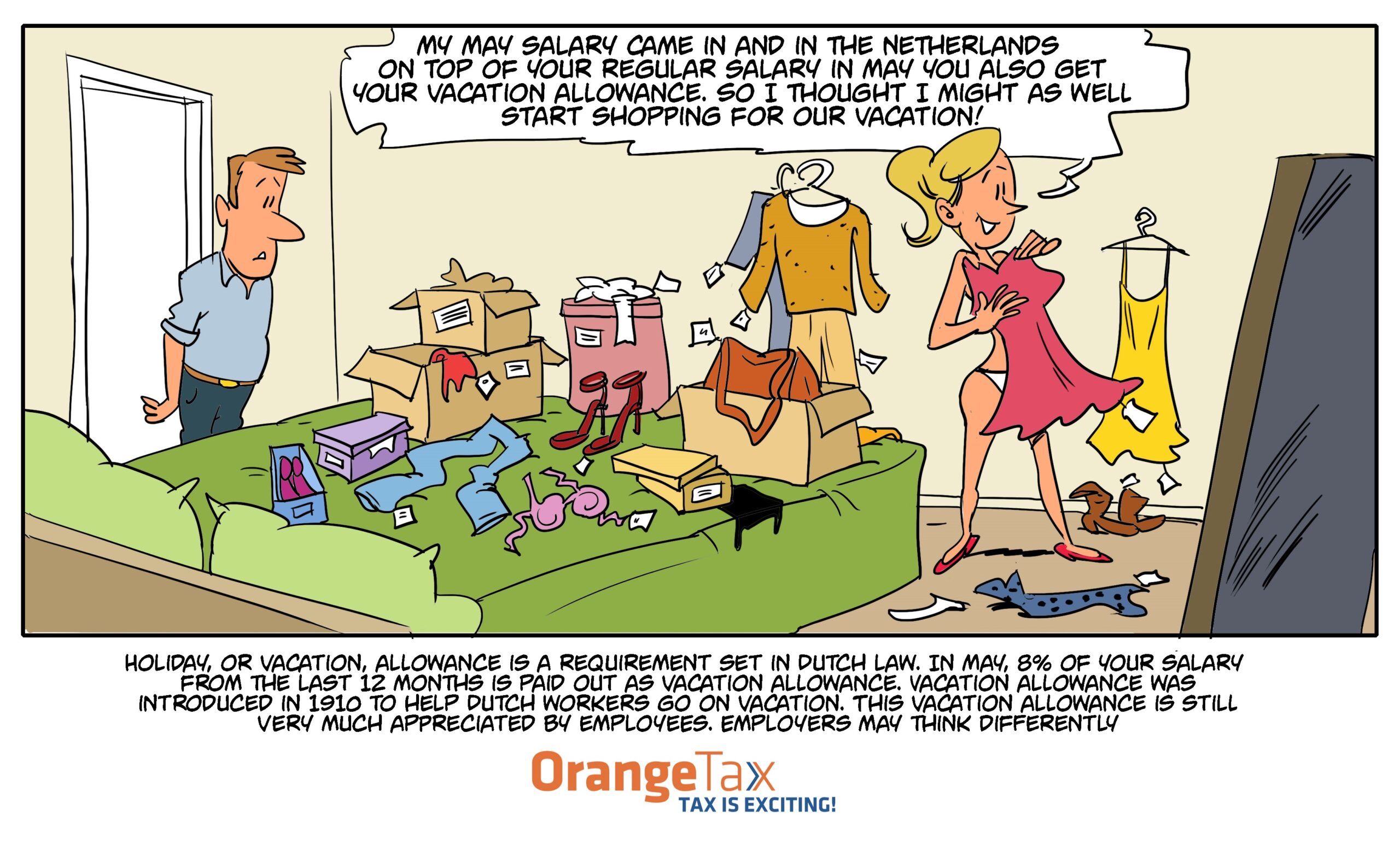

Doing business in the Netherlands can involve employment. Employment and Dutch taxation are sometimes a topic of hesitance due to the Dutch tax rates. Doing

Dutch corporate income tax penalties are serious amounts. Nothing exciting about the penalties, but we are excited to see how we can prevent penalties for

US Inc doing business in the Netherlands. That involves a registration in the Netherlands, but which one do you chose? US Inc doing business in

Maintaining your US Inc in the Netherlands. That is often a desire for many reasons. We will be pleased to assist you. Maintaining your US

Being a sole director of a foreign company residing in the Netherlands, makes the foreign company subject to Dutch rules and taxation. How does that

No tax audit due to missing administration? Submitting your administration with the garbage, does that make you cannot be audited? That is the question. Court

Employer abroad – working remote – Dutch taxation that is a frequently asked question, the answer is simple, the execution not always. Employer abroad –

The 2024 tax assessment. Maybe you already received it, and the year hardly began! Can I not simply ignore it? No you cannot. Here is

For deeper coverage of various Dutch tax topics, download one of our White Papers from the menu.