Managing director salary 2015

Currently we are in the middle of October, soon it is November and December is always the short holiday month.

1016 CS Amsterdam

Lines close at 4pm

Our office hours

Currently we are in the middle of October, soon it is November and December is always the short holiday month.

A common situation is that a foreign company hires a Dutch resident person to work for them. The work is

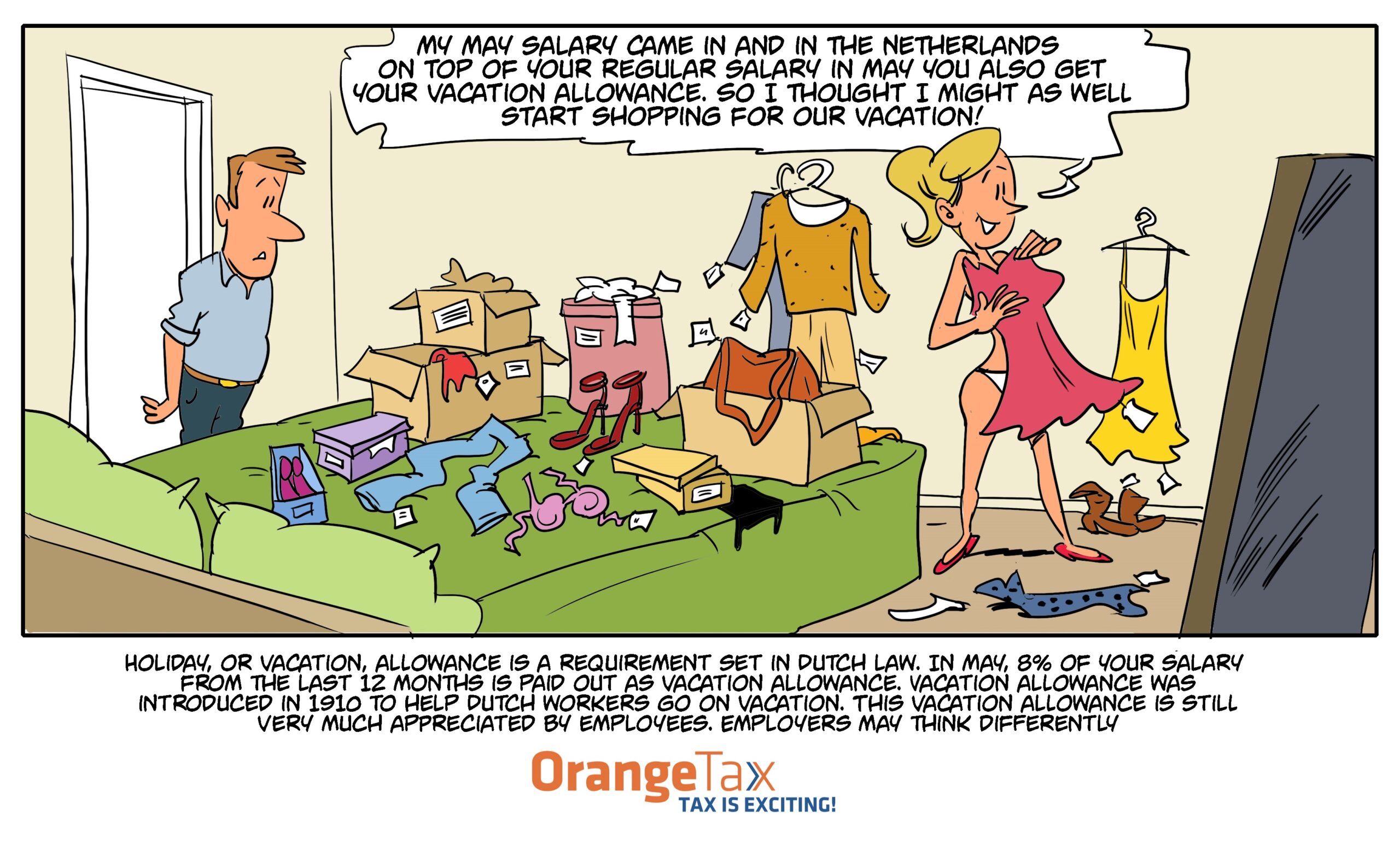

Holiday pay The month of May is a special month for employees in the Netherlands, as this is the month

Filing an income tax return is not everybody’s hobby, but it could earn you money. Migration Migration is the moment

We informed you earlier about the fact that it is easy to start doing business in Holland. Once you set

Employer abroad – working remote – Dutch taxation that is a frequently asked question, the answer is simple, the execution

All my costs are deductible business costs. Such type of clients we once in a while have among our clientele.

Entrepreneurs deduction 1225 hours implies that the taxable profit is significantly reduced. What happens if the tax office challenges the

What are the income tax deadlines in the Netherlands. An obvious question for the Dutch, but if you just arrived

Holidays are coming and you travel to your US family. To spend more time there you travel earlier and continue

For deeper coverage of various Dutch tax topics, download one of our White Papers from the menu.

The Annual Income Statement (AIS) is a document stating your annual income, income tax deducted and any applied credits. Your employer will issue it early in the year after the year of the tax return.

Please also give details of benefits with the AIS from the UWV.

NB Salary slips are not the same as an AIS. If you cannot obtain your AIS, we can use your salary slips but these may not be accurate and may be updated by the figures given to the Tax Office by your employer.

If you have foreign income, send us the AIS for this if possible. Otherwise provide salary slips. We also need to know if the work was performed abroad or remotely from NL.