One client is no client – changes as per January 1, 2025

One client is no client in 2025 is the standpoint of the Dutch tax office. Rules will be enforced from

1016 CS Amsterdam

Lines close at 4pm

Our office hours

One client is no client in 2025 is the standpoint of the Dutch tax office. Rules will be enforced from

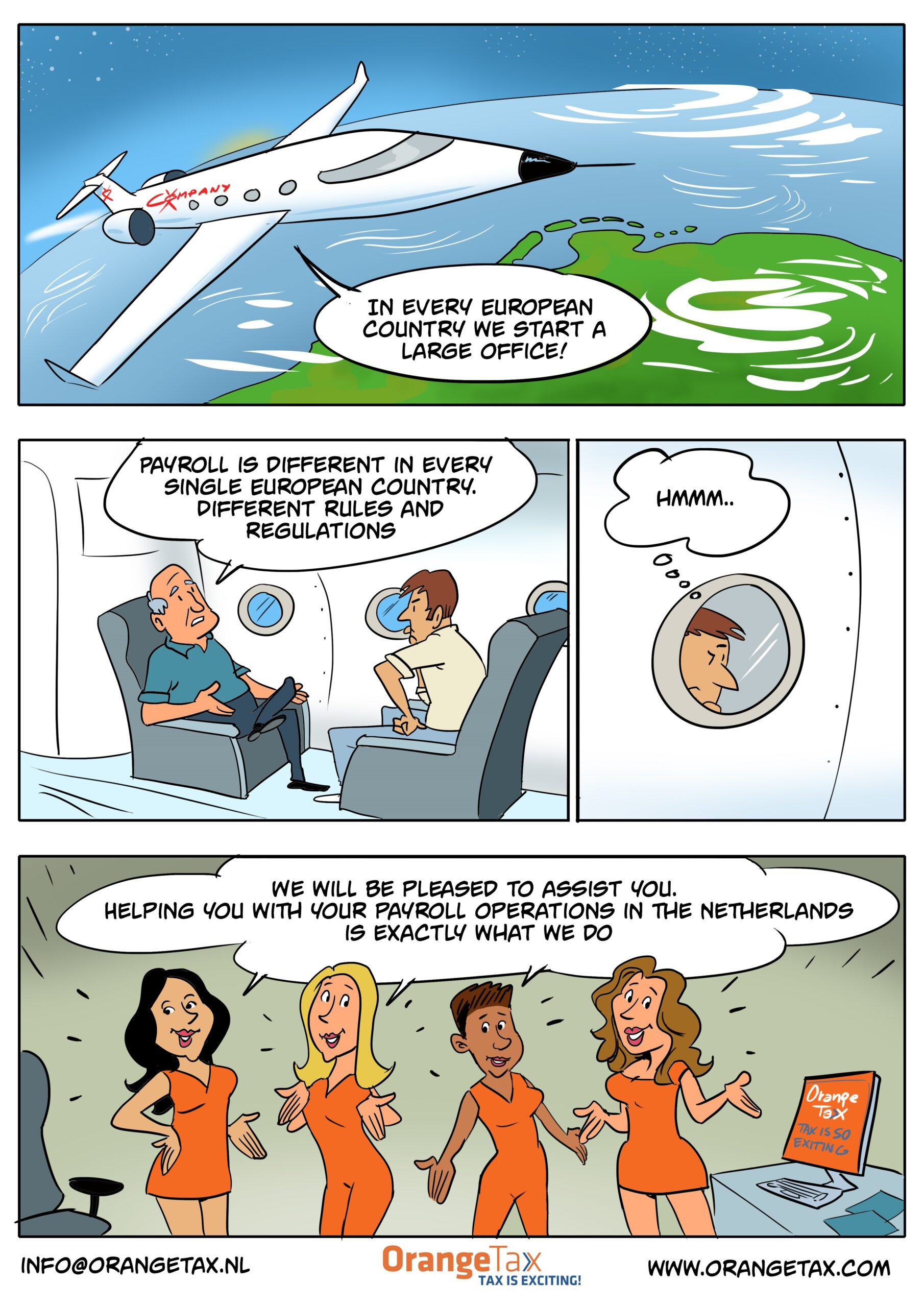

Doing business in the Netherlands can involve employment. Employment and Dutch taxation are sometimes a topic of hesitance due to

We have an employee in the Netherlands! This could cause distress with foreign employers. The only stories told to them,

File 2022 income tax return with us! I could have been more modest on the title, but modesty does not

Vacation allowance or holiday pay is a hot topic in the month of May in the Netherlands. Hot with the

We are frequently contacted about setting up a payroll in the Netherlands by foreign companies. For some the Dutch rules

The maximum income tax rate in the Netherlands is 51.75% or as we refer to the 52% tax rate. How

The 30% ruling is a benefit with a time restriction to the use of this ruling that soon will be

As per May 1, 2016 the so called VAR statement is abolished. This implies an entrepreneur is no longer able

Black Friday is coming and it is big. The mirror states that In three short years Black Friday has become the

For deeper coverage of various Dutch tax topics, download one of our White Papers from the menu.

The Annual Income Statement (AIS) is a document stating your annual income, income tax deducted and any applied credits. Your employer will issue it early in the year after the year of the tax return.

Please also give details of benefits with the AIS from the UWV.

NB Salary slips are not the same as an AIS. If you cannot obtain your AIS, we can use your salary slips but these may not be accurate and may be updated by the figures given to the Tax Office by your employer.

If you have foreign income, send us the AIS for this if possible. Otherwise provide salary slips. We also need to know if the work was performed abroad or remotely from NL.