Driving a company car implies you enjoy a benefit in kind. This benefit is taken into account for 4% up to 25% of the new Dutch catalogue value of the concerning car. Currently the 4% is for zero emission cars. How will this change as per 2017?

4% added to the income

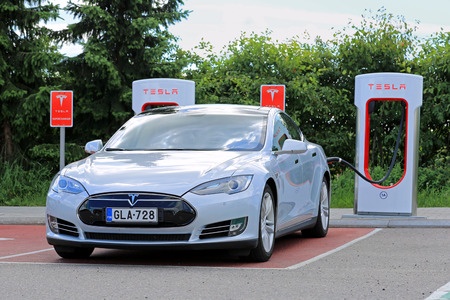

Driving a zero emission car such as a Tesla implies you enjoy a EUR 120.000 car at 4% added to your income per year, being EUR 4.800, which is EUR 400 per month added in kind to your income. What your employer pays for this car per month we do not take into account, as in this article we more or less assume you are the employer as well, so who cares?

2017 update on the company car taxation

In the Netherlands the policy on electronic company cars has been a bit too enthusiastic it turns out. Up to 2013 you could drive a zero emission company car and have a 0% benefit in kind for this car. Most employees do not care much about the emission, but 0% for the benefit in kind is very much appreciated. Hence the EU volume Tesla had in mind to sell were all sold in the Netherlands in 2013 I have been told. Mitsubishi outlander almost had a waiting list in 2013, and in 2014 when this car was in the 4% category for the benefit in kind, hardly sold anymore. That is to put in perspective how Dutch employees look at the benefit in kind policy on company cars.

We think it is therefore important for you to learn that as of 2017 the rules will be changed again. Zero emission cars up to EUR 50.000 will have 4% added to the income. Any value exceeding this amount is taken into account for the 22% benefit in kind.

Example calculation change as per 2017

Example, the Tesla is now EUR 4.800 per year in benefit in kind. As of 2017 that will be, if the Tesla is then still EUR 120.000, EUR 17.400, being EUR 1.450 per month added to your income. More than EUR 1000 extra for the same car.

High end company cars

High end company cars often have a waiting list period before you can order or it takes a bit longer to have them delivered. We recommend you to investigate what possibilities you have under the current system. The Dutch Government then issues a five year valid status on this car, which implies if delivered in 2016, you have from that year still 5 years the benefit of the existing rules in 2016. If you take into account the example calculation above, that could be an incentive to order now.